The Chamber of Commerce feel a landmark tax agreement between the Isle of Man and UK will do nothing to deter financial institutions coming to the Island.

The cooperation agreement is geared toward stamping out UK tax evaders.

Under the plans the Isle of Man will be expected to share a wide range of financial information on UK tax payers with accounts here, to HM Revenue and Customs.

Mike Hennessy of the Chamber of Commerce says it’s a positive move, as those set to suffer under the agreement are not the types of clients the Island wants to attract anyway:

(AUDIO ABOVE)

Second weather warning this weekend

Second weather warning this weekend

Does government plan to press ahead with min wage rise?

Does government plan to press ahead with min wage rise?

Where has government found £11m in savings?

Where has government found £11m in savings?

Is there border security for Irish sailings?

Is there border security for Irish sailings?

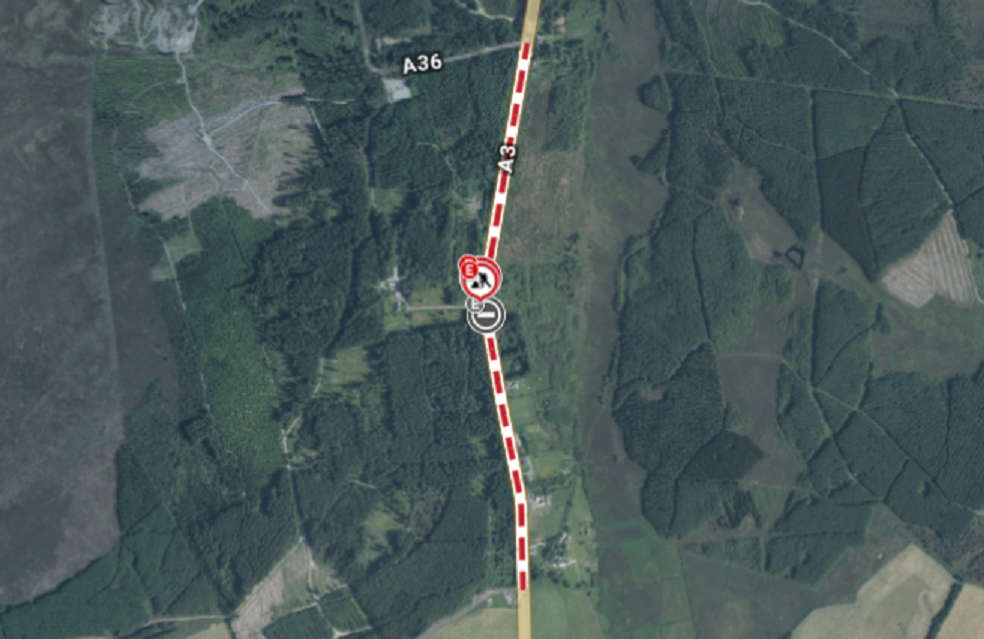

Emergency powers used to fell trees

Emergency powers used to fell trees

Busy road in West to close next week

Busy road in West to close next week

Free period products would cost £90k in 1st year

Free period products would cost £90k in 1st year

MHK wants to know about bail condition breaches

MHK wants to know about bail condition breaches