An on Island Tax Amnesty between July and September has led to almost £10 million of previously undisclosed income being declared.

The scheme operated between 1 July 2010 and 30 September 2010, and it resulted in 105 voluntary disclosures being made.

The amnesty was announced in the Budget Speech earlier in the year, it gave taxpayers the chance to make voluntary disclosures without the threat of a penalty.

On top of the declared income an additional £1.88 million of income tax has been collected following these disclosures.

Despite now being closed, you’re still able to correct errors or omissions on your returns without incurring penalty charges.

Glen Helen's Swiss Chalet up for rent

Glen Helen's Swiss Chalet up for rent

UK taxman lists Isle of Man tax avoidance schemes and promoters

UK taxman lists Isle of Man tax avoidance schemes and promoters

More than 2,300 calls to 999 last month

More than 2,300 calls to 999 last month

New Captain of the Parish named for Bride

New Captain of the Parish named for Bride

Online petition calls for windfarm referendum

Online petition calls for windfarm referendum

Government considers jury service changes

Government considers jury service changes

Protect lambs - keep your dog under control!

Protect lambs - keep your dog under control!

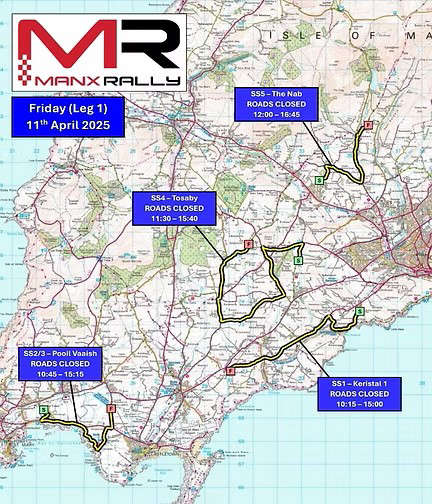

2025 Manx Rally starts today!

2025 Manx Rally starts today!